Personal Tax Changes In 2020

This month, Barwon Financial Planning takes a look at personal tax changes following the 2020 Federal budget and what this means for you.

Personal Tax Changes

Personal tax changes announced in the Federal Budget are now in place for the current 2020-21 financial year. These changes have seen a tax savings for many Australian taxpayers with the increase to the low income and low to middle income tax offsets.

Low Income Tax Offset (LITO): The maximum low income tax offset has increased from $445 to $700. Taxpayers earning up to $37,500 can receive the full $700 offset with a sliding scale for incomes up to $66,667.

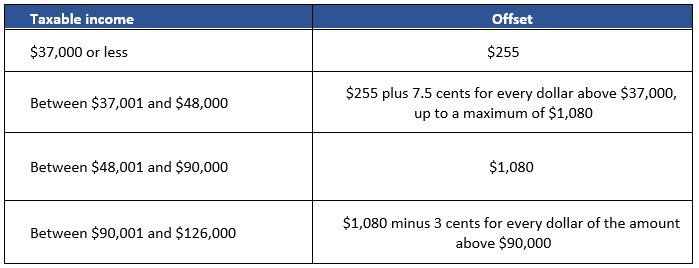

Low and Middle Income Offset (LMITO): Depending on your taxable income you maybe eligible to receive the low and middle income tax offset of between $255 and $1,080 (see table below).

Low and Middle Income Offset (LMITO) Table

Seniors and Pensioners Tax Offset (SAPTO): If you're a senior Australian, you may be eligible for the seniors and pensioners tax offset (SAPTO). For singles the maximum tax offset is $2,230 and $1,602 each for a couple. Eligibility criteria apply.

The following tables outline the legislated effective tax- free thresholds for the 2020/21 Financial Year.

Resident Individuals (Not Eligible for SAPTO)

Effectively, you can earn up to $23,226 of taxable income and pay nil tax.

Resident Individuals (Eligible for SAPTO)

In summary, if you are a senior Australian who is eligible to receive the SAPTO you can effectively earn up $33,898 for a single or $30,592 for each member of a couple and pay nil tax.

Note: It is unclear whether SAPTO will also be changing this financial year. This means there is a risk that the effective tax-free threshold for those eligible for SAPTO may change and vary from the threshold shown above.

If you have questions about how personal tax changes impact you, please contact us for a free consultation.